Adams & Associates - Learn with Us

Event Insurance in Hawaii: Protecting Your Community and Business Gatherings

Planning an event in Hawaii? Whether you're organizing a community luau in Kailua-Kona, a corporate retreat on Maui, or a wedding reception at Kualoa Ranch, one question should top your list: What happens if something goes wrong?

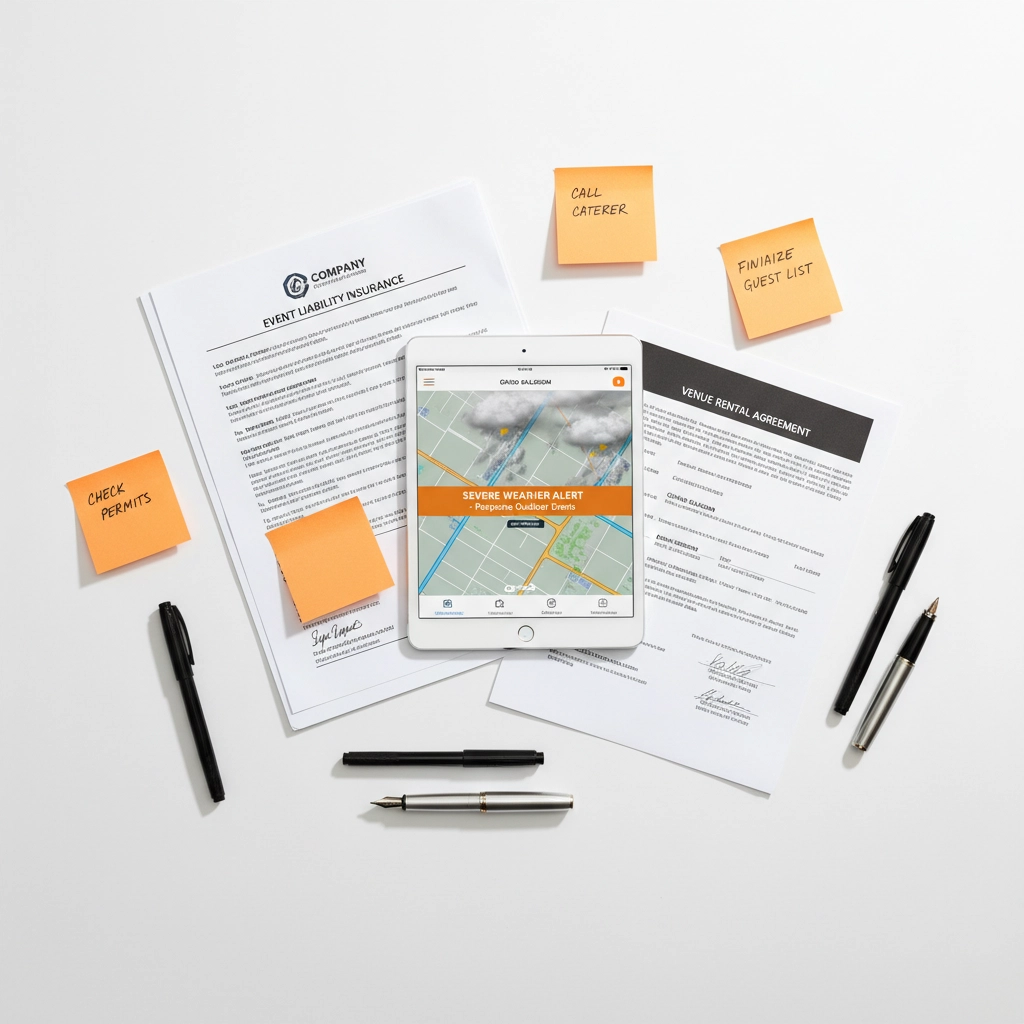

Event insurance might not be the most exciting part of planning, but it's one of the smartest investments you can make. From sudden rainstorms to vendor no-shows, Hawaii's unique environment creates both opportunities and risks that every event organizer needs to understand.

Why Every Hawaii Event Needs Protection

Hawaii's paradise setting doesn't make events immune to problems. In fact, our islands present some unique challenges that make insurance even more important.

Weather surprises hit fast here. That perfect beach wedding can turn into a soggy mess when trade winds shift. Corporate events at outdoor venues face similar risks when unexpected storms roll in.

Vendor reliability becomes critical when you're on an island. If your caterer from Oahu can't make it to your Big Island event due to flight cancellations, you're stuck with hungry guests and no backup plan.

Guest injuries happen more often than you'd think. Slippery surfaces from ocean spray, uneven terrain at beach venues, or someone getting hurt during traditional Hawaiian activities can lead to serious liability issues.

Community Events vs. Corporate Gatherings: Different Needs, Different Coverage

Community and Nonprofit Events

Hawaii's strong community spirit means lots of local gatherings. Church fundraisers, school festivals, cultural celebrations, and neighborhood block parties all bring people together. These events typically need:

Basic liability coverage for accidents and injuries. When 200 people gather for your church's annual plate lunch sale, someone might slip on the wet grass or get food poisoning.

Property coverage for borrowed or rented equipment. That expensive sound system for your community concert needs protection if it gets damaged by salt air or unexpected rain.

Volunteer accident coverage because regular workers' compensation doesn't cover volunteers. When your kokua helpers get hurt setting up the bounce house, this coverage steps in.

Corporate and Business Events

Business events in Hawaii often involve higher stakes and bigger budgets. Company retreats, product launches, client entertainment, and professional conferences require more comprehensive protection:

Professional liability coverage protects against claims when your event doesn't meet expectations. If that expensive keynote speaker doesn't show up for your conference, attendees might seek compensation.

Cyber liability protection becomes important for events using digital components, registration systems, or collecting attendee data.

Employment practices coverage helps when workplace issues arise during company events. Office parties and retreats sometimes lead to harassment or discrimination claims.

Essential Coverage Types Every Hawaii Event Needs

General Liability Insurance

This is your foundation coverage. It protects when:

- Someone gets injured at your event

- Property gets damaged during setup or breakdown

- You accidentally damage the venue

- Food poisoning occurs from catered meals

Hawaii requirement: Most venues require at least $1 million in general liability coverage before you can book.

Event Cancellation Insurance

Hawaii's weather and remote location make this coverage crucial. It covers costs when you have to:

- Cancel due to severe weather (hurricanes, flash floods, high winds)

- Postpone because key vendors can't reach the venue

- Relocate when your original venue becomes unavailable

- Continue with reduced services when suppliers fail to deliver

Liquor Liability Insurance

Serving alcohol at Hawaii events creates additional risks. This coverage protects when:

- Intoxicated guests cause property damage

- Someone gets hurt due to over-serving

- Legal issues arise from underage drinking

- Drunk driving accidents happen after your event

Important note: Some venues require separate liquor liability even if you're only serving beer and wine.

Hawaii-Specific Insurance Requirements

State and County Rules

Different venues across Hawaii have different insurance requirements. For example:

Hawaii Community Development Authority parks(including Kaka'ako areas) require:

- $1 million per occurrence, $2 million aggregate general liability

- Additional insured status for HCDA and State of Hawaii

- $100,000 damage to rented premises coverage

Private venues often set their own minimums, typically ranging from $1-2 million in coverage.

Food service events need additional health department compliance and may require higher liability limits.

Island-Specific Considerations

Oahu events face unique challenges with traffic, parking, and crowd control that might increase liability risks.

Neighbor island events deal with vendor transportation issues, limited backup options, and higher cancellation risks due to weather affecting inter-island travel.

Beach and ocean events require specialized coverage for water-related activities, environmental liability, and equipment protection from salt damage.

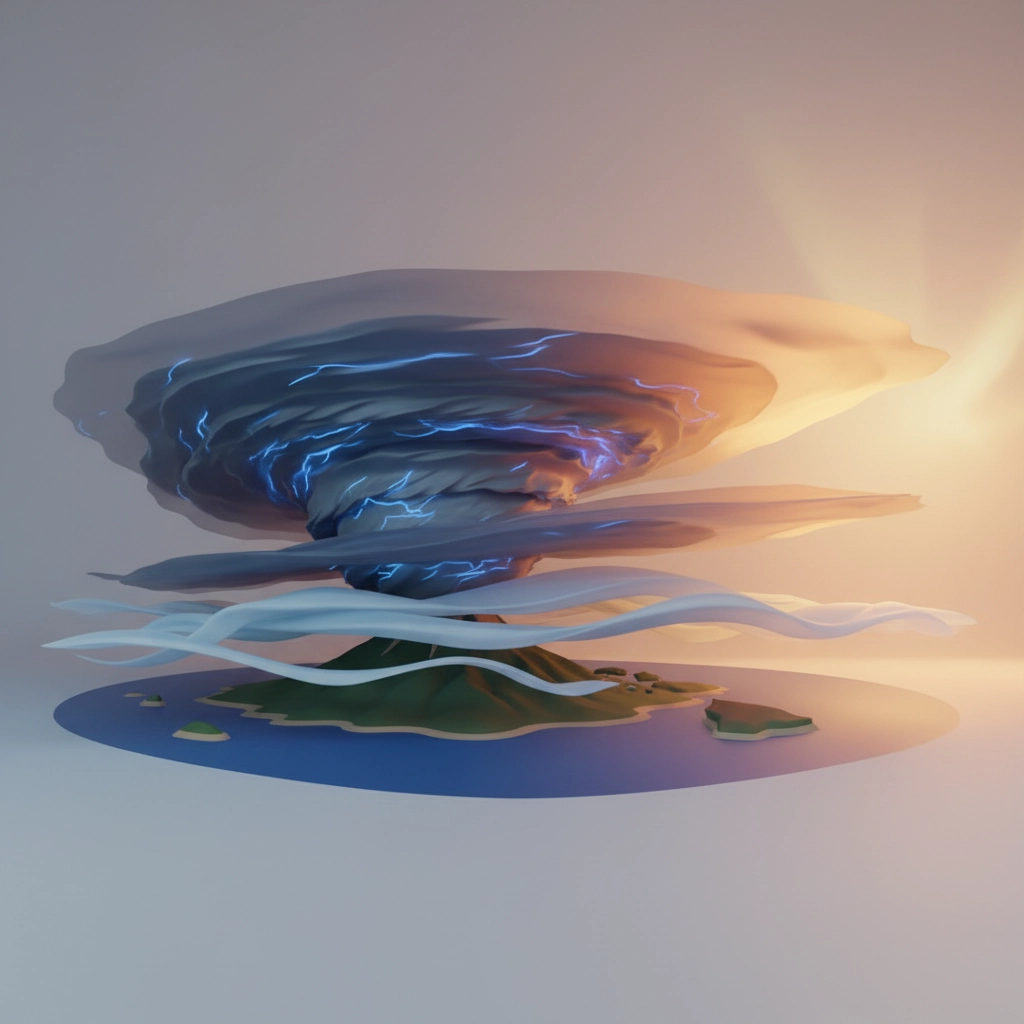

Weather and Seasonal Planning

Hawaii's "perfect weather" reputation doesn't tell the whole story. Smart event planners know:

Hurricane Season (June-November)

- Cancellation insurance becomes essential

- Monitor weather forecasts 2-3 weeks out

- Have solid backup venue arrangements

- Consider postponement rather than cancellation

Trade Wind Seasons

- Protect tents and decorations from sudden gusts

- Plan for equipment damage from wind and rain

- Consider indoor backup options for critical moments

Vog and Air Quality

- Big Island events may face volcanic smog issues

- Health considerations for outdoor gatherings

- Equipment protection from volcanic particles

Choosing the Right Coverage for Your Event

Start With the Basics

- Determine your venue requirements- Get specific insurance demands in writing

- Calculate your total event value- Include all vendors, equipment, and deposits

- Identify your biggest risks- Weather, vendor failure, or guest injuries

Consider Your Event Type

- One-time events: Short-term policies work best

- Annual events: Year-round coverage might offer better rates

- Series of events: Bundle coverage for cost savings

Don't Forget These Details

- Certificate timeline: Most venues need insurance certificates 30 days before your event

- Additional insured requirements: Make sure all required parties are properly listed

- Coverage territory: Ensure your policy covers all event locations and transportation

Questions to Ask Your Insurance Agent

Before signing any policy, make sure you understand:

- What specific perils are covered and excluded?

- How quickly can claims be processed and paid?

- Are there any restrictions on venue types or activities?

- Does coverage extend to setup and breakdown periods?

- What documentation is needed for claims?

- Are there any seasonal restrictions or rate changes?

Making Event Insurance Work for You

The best event insurance is the coverage you never have to use. But when problems arise - and they will - having the right protection lets you focus on your guests instead of worrying about financial disasters.

Start early: Don't wait until the last minute. Good coverage takes time to arrange properly.

Read carefully: Make sure you understand what's covered and what isn't.

Keep records: Document everything for potential claims.

Stay in touch: Notify your agent of any major changes to your event plans.

Remember, event insurance isn't about expecting the worst - it's about being prepared so you can focus on creating amazing experiences for your guests. Whether you're planning a small community gathering or a major corporate event, the right insurance coverage gives you peace of mind to enjoy your own party.

Ready to protect your next Hawaii event? Getting the right coverage doesn't have to be complicated when you work with agents who understand our unique island challenges.