Adams & Associates - Learn with Us

Is Your Condo Association Underinsured? Here's the Truth About Hawaii's Coverage Crisis

If you're on a condo association board or own a unit in Hawaii, you've probably noticed something troubling lately. Insurance premiums are skyrocketing, and you're hearing whispers about buildings that can't get full coverage.

Here's the reality: about 400 condominium buildings across Hawaii now carry less than 100% replacement coverage. That's not just a number – it's hundreds of thousands of residents living in potentially underinsured buildings.

Let's break down what this means for you and what you can do about it.

What Does "Underinsured" Actually Mean?

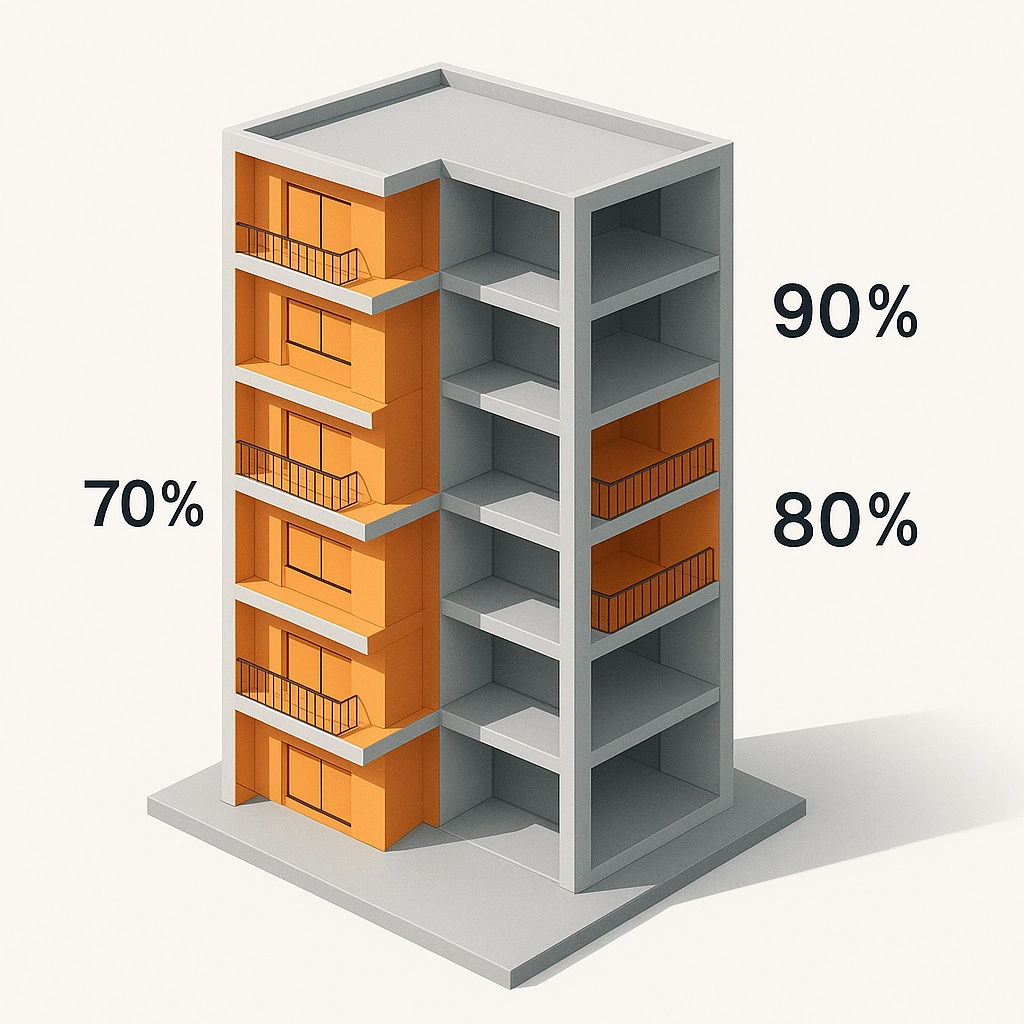

Think of it this way: if your building would cost $10 million to rebuild from scratch, but your insurance only covers $7 million, you're 30% underinsured. That missing $3 million? It comes out of unit owners' pockets through special assessments.

Underinsurance happens when:

- Your master policy doesn't cover the full replacement cost of your building

- Coverage gaps exist for certain types of damage

- Your policy limits haven't kept up with rising construction costs

Many associations are choosing reduced coverage because full coverage has become unaffordable. Some buildings have seen premium increases of 300% to 1,300% in a single year.

Why Hawaii Got Hit So Hard

Hawaii's insurance crisis didn't happen overnight. Several factors created a perfect storm:

Aging Buildings Most condos here are over 30 years old, especially in Honolulu. When your building needs new pipes, roof repairs, or structural work, insurers take notice. Deferred maintenance creates a downward spiral – the more repairs you need, the harder (and more expensive) insurance becomes.

Global Market Pressures Hawaii insurers pay to share risk with global reinsurance companies. When hurricanes devastate other areas or wildfires rage worldwide, those losses affect our premiums too. Global reinsurance losses have exceeded $100 billion annually for several years running.

Limited Options Several major insurers have stopped writing new policies in Hawaii. When there are fewer companies competing for your business, prices go up and coverage options shrink.

The Maui Factor The devastating 2023 Maui wildfires put Hawaii on insurers' radar as a wildfire state, adding another layer of risk they factor into pricing.

The Real Impact on Your Association

Underinsurance creates problems that ripple through your entire community:

Mortgage Complications Banks don't want to lend money for units in underinsured buildings. If your building lacks 100% replacement coverage, potential buyers may struggle to get financing. This affects unit values and how long properties stay on the market.

Special Assessments When disaster strikes an underinsured building, owners face massive special assessments to cover the gap between insurance payouts and actual rebuilding costs.

Maintenance Challenges Underinsured associations often struggle to secure loans for major repairs, creating a cycle where building conditions worsen and insurance becomes even harder to obtain.

Market Impact Condo prices are down and properties are staying on the market three times longer than they did in 2022. Buyers are hesitant, lenders are cautious, and the entire market feels the effects.

Red Flags Your Association Might Be Underinsured

Watch for these warning signs:

- Premium increases over 50% in one year

- Coverage amounts that haven't been updated in 3+ years

- Policies that exclude key building components

- Difficulty finding insurers willing to quote

- Board discussions about "reducing coverage to save money"

What Your Association Can Do Right Now

Don't wait for disaster to strike. Here are practical steps your board can take:

Get a Professional Appraisal Have your building's replacement cost evaluated by a certified appraiser. Construction costs in Hawaii have increased dramatically, so your 2020 estimate may be way off.

Review Your Policy Thoroughly Look beyond the total coverage amount. Check for:

- Exclusions that might surprise you

- Coverage for code upgrades

- Loss of use provisions

- Ordinance and law coverage

Create a Maintenance Plan Insurers love well-maintained buildings. Document your maintenance efforts and create a long-term plan. Regular upkeep can help you negotiate better rates.

Shop Around (But Be Strategic) Don't just chase the lowest premium. Work with agents who understand Hawaii's market and can structure coverage that truly protects you.

Build Reserves Even with full coverage, you'll face deductibles and potential coverage gaps. Adequate reserves help your association weather storms – literally and figuratively.

State Help Is Available

Governor Josh Green issued an emergency proclamation recognizing this crisis. The state now offers hurricane insurance for associations that can't secure full coverage through regular markets.

New legislation passed in July 2025 aims to stabilize Hawaii's insurance market, particularly protecting seniors who are most vulnerable to price spikes and policy cancellations.

Questions to Ask Your Board

If you're a unit owner, here are key questions to bring up at your next association meeting:

- When was our replacement cost last evaluated?

- What percentage of replacement cost does our current policy cover?

- Have we explored state insurance options?

- What's our plan if we face a major loss?

- Are we keeping up with necessary maintenance?

The Bottom Line

Hawaii's condo insurance crisis is real, but it's not insurmountable. The key is facing it head-on with accurate information and proactive planning.

Yes, insurance costs more than it used to. Yes, some coverage options have disappeared. But associations that stay informed, maintain their buildings well, and work with knowledgeable professionals can still find adequate protection.

Remember: underinsurance isn't just about saving money on premiums. It's about protecting the biggest investment most of us will ever make – our homes.

The crisis affects everyone in "Condoland," from individual owners to mortgage lenders to insurance agents. But with the right approach, your association can navigate these challenges and keep your community protected.

Take action now. Don't wait for your renewal notice to arrive with shocking premium increases. Start the conversation with your board today, and make sure your building has the coverage it needs to weather whatever storms – literal or financial – come your way.

Your association's insurance decisions today will determine whether your community thrives or struggles in the years ahead. Make them count.